If you are a retail investor and looking for a Penny stock with a lot of upside potential then this stock is a good choice. Here is why I came to this conclusion.

When Baytex Energy was at 89 cents I invested in it with high hopes I was buying on a historic dip. I was right but I liquidated my position at just under $3 a share, a big mistake for me. I should have stayed long on this stock.its Now trading at just above $6 A SHARE.

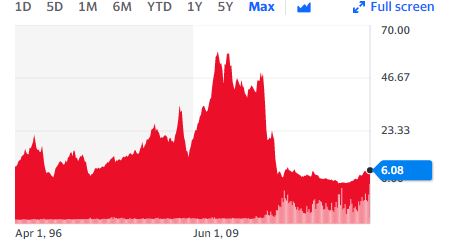

As you can see from the graph the investors who went long when buying the dip are in a good position today.

Baytex Energy’s historical price reveals a buy signal

This graph from yahoo finance shows a historical price of well over $40 a share.

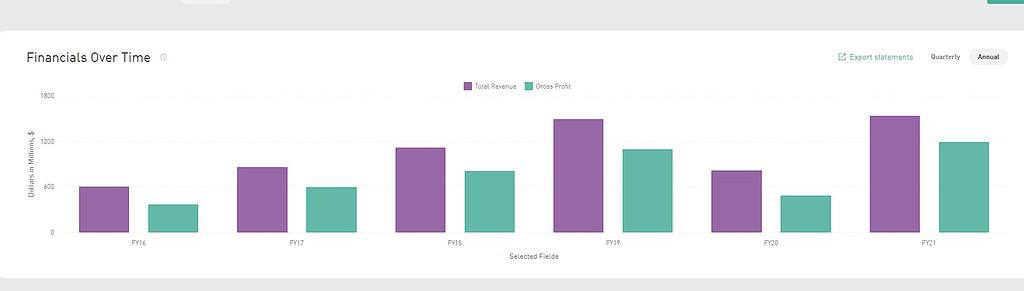

Baytex Energy revenue to profit annual report graph 2016-2021

This graph shows a positive and healthy operational status to support long-term viability for the investor.

What is Baytex energy’s core business?

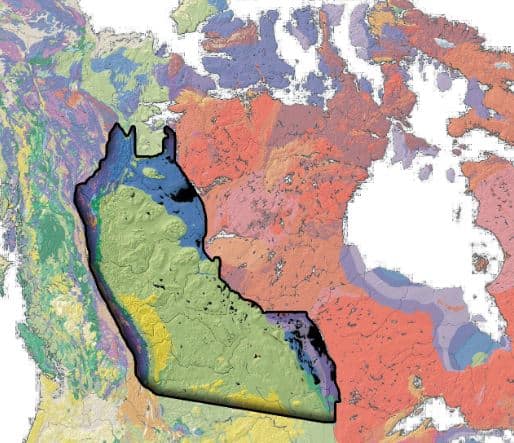

Baytex Energy Corp. is an energy company based in Calgary, Alberta. The company is engaged in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin.

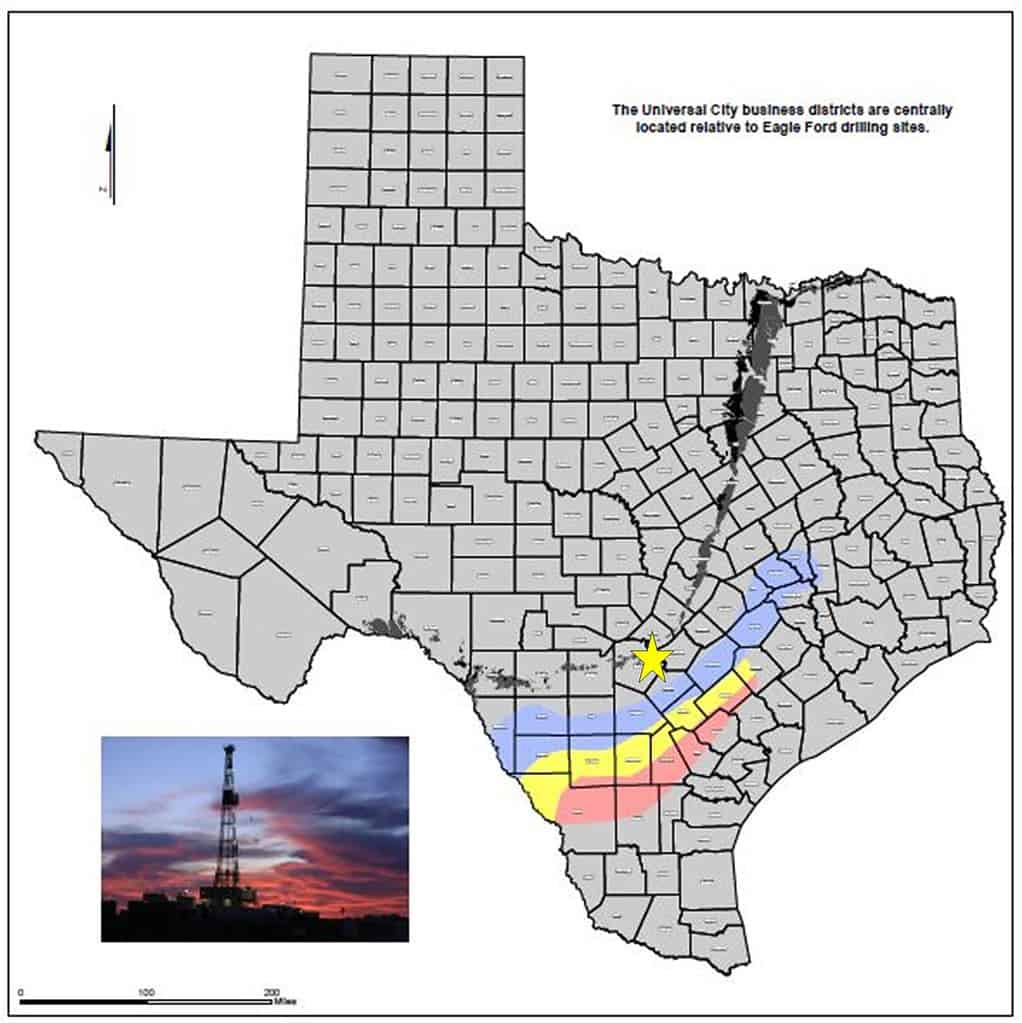

And also in the Eagle Ford in the United States.

Does Baytex Energy pay a dividend?

Baytex does not currently pay a dividend, but is targeting US$630 million in net debt to further increase shareholder returns and should hit this target by the end of 2022 now. The company is projected to pay a dividend in 2023